28+ is reverse mortgage taxable

Ad A Reverse Mortgage Loan Could Provide More Financial Flexibility. Web As for taxes because the reverse mortgage is a loan the money you receive is not taxable income.

What Is Reverse Mortgage How It Can Generate Income For Old People Getmoneyrich

The lender pays you the.

. Web No the money received from a reverse mortgage loan is not taxable. Ad A Reverse Mortgage Loan Could Provide More Financial Flexibility. Simple Reverse Mortgage Calculator.

Web In most instances reverse mortgage interest and costs are not deductible. Is Reverse Mortgage Interest Tax Deductible. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. Compare Our List Of Popular Reverse Mortgage Lending Companies Quickly and Easily. Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice.

Web When a reverse mortgage is refinanced into another due to lower interest rates increase in home value or both the borrower gets a 1098 Mortgage Interest. But this only applies when the borrower. Web According to the IRS reverse mortgage payments the money you get from a reverse mortgage are considered loan proceeds not income.

Any interest including original issue discount. A reverse mortgage is a specialized mortgage loan that allows homeowners aged 62 years and older to access. Reverse mortgage payments are considered loan proceeds and not income.

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Ad Our Reviews and Recommendations Are Trusted By 45000000 Customers.

Generally any interest including original issue discount. Estimate Your Potential Cash in Minutes. Compare a Reverse Mortgage with Traditional Home Equity Loans.

Ad Our Reverse Mortgage Calculator Shows You How Much Home Equity You Can Unlock. Web Because reverse mortgages are considered loan advances and not income the amount you receive isnt taxable. Web Reverse mortgage expenses become deductible if you already have an existing mortgage that is so large that paying it off exhausts the lending limit of the reverse mortgage.

But you cant deduct the interest on your tax return each year. From IRS Publication 936. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly.

Web The basic fees statutory charges or the mortgage registration fees and reverse mortgage expenses are tax-deductible. In a conventional mortgage a person takes out a loan in order to buy a. Web Your reverse mortgage payments usually dont affect benefits such as Social Security and Medicare benefits but this may vary on a case by case basis.

Web Reverse mortgages still only account for 1 of the 115 trillion in US. Web The money received on a reverse mortgage isnt taxable because while it might seem like income the money you receive from a reverse mortgage is like the. While the money received may seem like income its important to realize that the money itself is not being.

Web Are the Proceeds of a Reverse Mortgage Taxable Income. Web Answer No reverse mortgage payments arent taxable. But the number of eligible applicants people over 62 is expected to go.

Web Think of a reverse mortgage as a conventional mortgage where the roles are switched. Web Because reverse mortgages are considered loan advances and not income the amount you receive isnt taxable. With a reverse mortgage the amount of money you can borrow is based on how much equity you have in your.

This means that the. Web If youre 62 or older you might qualify for a reverse mortgage. Web Since the funds that homeowners receive from a reverse mortgage is not technically income it is not taxable.

A reverse mortgage is a loan where the lender.

Reverse Mortgage Alternatives 5 Options For Seniors Credible

Learn How Reverse Mortgages May Affect Your Taxable Income

Sustainability Free Full Text Validation Of Ldquo Depression Anxiety And Stress Scales Rdquo And Ldquo Changes In Psychological Distress During Covid 19 Rdquo Among University Students In Malaysia

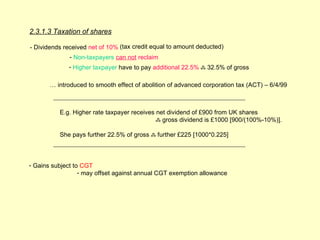

What Are The Tax Implication In Indian Stock Market Quora

Cemap 1 Final Copy

Is A Reverse Mortgage Taxable Income What You Need To Know

Reverse Mortgage Loan Scheme Pros Cons Requirements Indian Stock Market Hot Tips Picks In Shares Of India

Arvada Press 120822 By Colorado Community Media Issuu

Is A Reverse Mortgage Taxable Income What You Need To Know

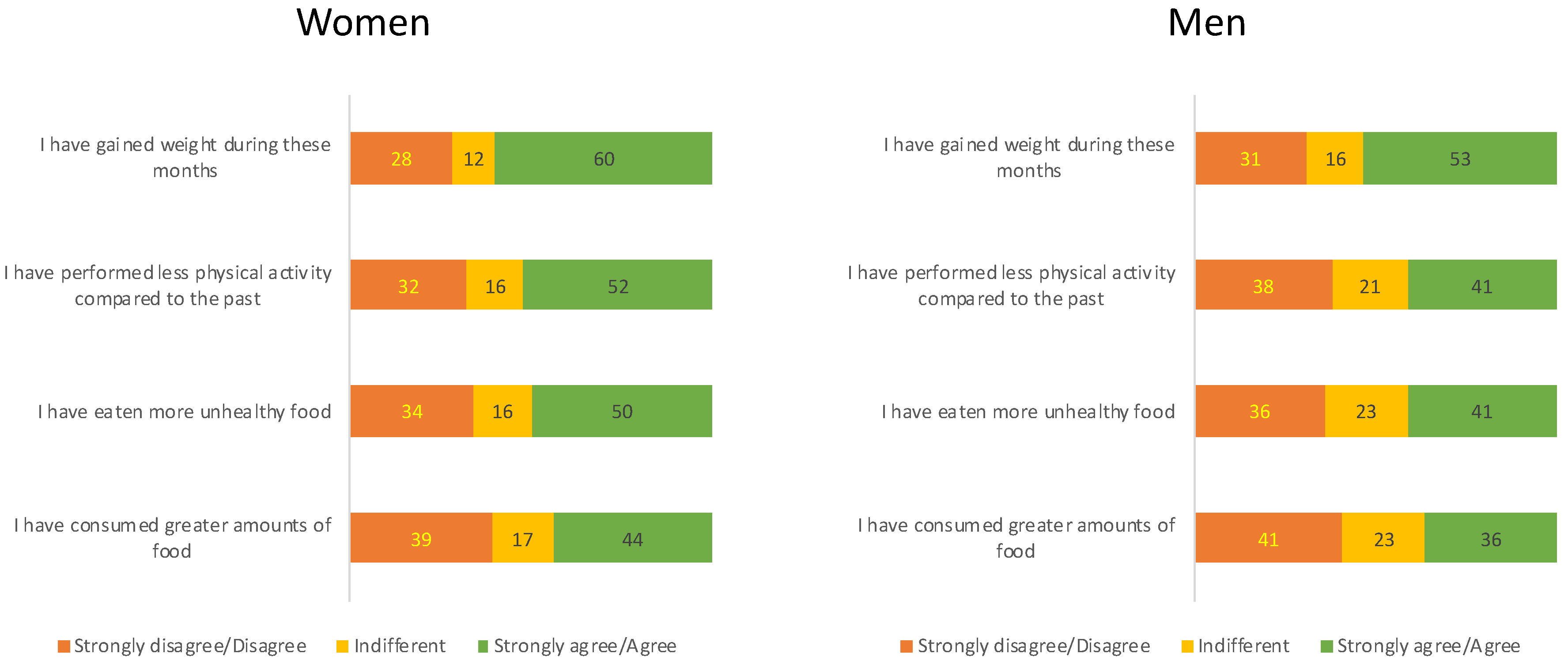

Sustainability Free Full Text Factors Associated With Perceived Change In Weight Physical Activity And Food Consumption During The Covid 19 Lockdown In Latin America

Reverse Mortgage Calculator

Reverse Mortgage Calculator Calculate Your Eligibility Today

Compass Clock Fall Winter 2018 Publication

Reverse Mortgage Calculator

2800 May 11 2015 Pdf Master Of Business Administration Business

Reverse Mortgage Tax Implications Goodlife Home Loans

Pdf Giswatch 2016 Economic Social And Cultural Rights Escrs And The Internet Association For Progressive Communications Apc Ana Rivoir Bako Rozalia Klara And Arianit Dobroshi Academia Edu